회귀 (Regression) 예측

특성: 수치형 값을 예측 (Y의 값이 연속형 수치로 표현)

예시:

-

주택 가격 예측

-

매출앵 예측

0. 데이터 셋

1 | import pandas as pd |

1 | from sklearn.datasets import load_boston |

0-1. 데이터 로드

1 | data = load_boston() |

1 | print(data['DESCR']) # data description |

.. _boston_dataset:

Boston house prices dataset

---------------------------

**Data Set Characteristics:**

:Number of Instances: 506

:Number of Attributes: 13 numeric/categorical predictive. Median Value (attribute 14) is usually the target.

:Attribute Information (in order):

- CRIM per capita crime rate by town

- ZN proportion of residential land zoned for lots over 25,000 sq.ft.

- INDUS proportion of non-retail business acres per town

- CHAS Charles River dummy variable (= 1 if tract bounds river; 0 otherwise)

- NOX nitric oxides concentration (parts per 10 million)

- RM average number of rooms per dwelling

- AGE proportion of owner-occupied units built prior to 1940

- DIS weighted distances to five Boston employment centres

- RAD index of accessibility to radial highways

- TAX full-value property-tax rate per $10,000

- PTRATIO pupil-teacher ratio by town

- B 1000(Bk - 0.63)^2 where Bk is the proportion of blacks by town

- LSTAT % lower status of the population

- MEDV Median value of owner-occupied homes in $1000's

:Missing Attribute Values: None

:Creator: Harrison, D. and Rubinfeld, D.L.

This is a copy of UCI ML housing dataset.

https://archive.ics.uci.edu/ml/machine-learning-databases/housing/

This dataset was taken from the StatLib library which is maintained at Carnegie Mellon University.

The Boston house-price data of Harrison, D. and Rubinfeld, D.L. 'Hedonic

prices and the demand for clean air', J. Environ. Economics & Management,

vol.5, 81-102, 1978. Used in Belsley, Kuh & Welsch, 'Regression diagnostics

...', Wiley, 1980. N.B. Various transformations are used in the table on

pages 244-261 of the latter.

The Boston house-price data has been used in many machine learning papers that address regression

problems.

.. topic:: References

- Belsley, Kuh & Welsch, 'Regression diagnostics: Identifying Influential Data and Sources of Collinearity', Wiley, 1980. 244-261.

- Quinlan,R. (1993). Combining Instance-Based and Model-Based Learning. In Proceedings on the Tenth International Conference of Machine Learning, 236-243, University of Massachusetts, Amherst. Morgan Kaufmann.

0-2. 데이터프레임 만들기

1 | # step 1. features (X) |

1 | df.head() |

| CRIM | ZN | INDUS | CHAS | NOX | RM | AGE | DIS | RAD | TAX | PTRATIO | B | LSTAT | MEDV | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.00632 | 18.0 | 2.31 | 0.0 | 0.538 | 6.575 | 65.2 | 4.0900 | 1.0 | 296.0 | 15.3 | 396.90 | 4.98 | 24.0 |

| 1 | 0.02731 | 0.0 | 7.07 | 0.0 | 0.469 | 6.421 | 78.9 | 4.9671 | 2.0 | 242.0 | 17.8 | 396.90 | 9.14 | 21.6 |

| 2 | 0.02729 | 0.0 | 7.07 | 0.0 | 0.469 | 7.185 | 61.1 | 4.9671 | 2.0 | 242.0 | 17.8 | 392.83 | 4.03 | 34.7 |

| 3 | 0.03237 | 0.0 | 2.18 | 0.0 | 0.458 | 6.998 | 45.8 | 6.0622 | 3.0 | 222.0 | 18.7 | 394.63 | 2.94 | 33.4 |

| 4 | 0.06905 | 0.0 | 2.18 | 0.0 | 0.458 | 7.147 | 54.2 | 6.0622 | 3.0 | 222.0 | 18.7 | 396.90 | 5.33 | 36.2 |

컬럼 소게 (feature 13 + target 1):

-

CRIM: 범죄율

-

ZN: 25,000 square feet 당 주거용 토지의 비율

-

INDUS: 비소매(non-retail) 비즈니스 면적 비율

-

CHAS: 찰스 강 더미 변수 (통로가 하천을 향하면 1; 그렇지 않으면 0)

-

NOX: 산화 질소 농도 (천만 분의 1)

-

RM:주거 당 평균 객실 수

-

AGE: 1940 년 이전에 건축된 자가 소유 점유 비율

-

DIS: 5 개의 보스턴 고용 센터까지의 가중 거리

-

RAD: 고속도로 접근성 지수

-

TAX: 10,000 달러 당 전체 가치 재산 세율

-

PTRATIO 도시 별 학생-교사 비율

-

B: 1000 (Bk-0.63) ^ 2 여기서 Bk는 도시 별 검정 비율입니다.

-

LSTAT: 인구의 낮은 지위

-

MEDV: 자가 주택의 중앙값 (1,000 달러 단위)

1. Training set / Test set 나누기

1 | from sklearn.model_selection import train_test_split |

1 | x_train, x_test, y_train, y_test = train_test_split(df.drop('MEDV', 1), df['MEDV'], random_state=23) |

1 | x_train.shape, y_train.shape |

((379, 13), (379,))

1 | x_test.shape, y_test.shape |

((127, 13), (127,))

1 | x_train.head() |

| CRIM | ZN | INDUS | CHAS | NOX | RM | AGE | DIS | RAD | TAX | PTRATIO | B | LSTAT | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 112 | 0.12329 | 0.0 | 10.01 | 0.0 | 0.547 | 5.913 | 92.9 | 2.3534 | 6.0 | 432.0 | 17.8 | 394.95 | 16.21 |

| 301 | 0.03537 | 34.0 | 6.09 | 0.0 | 0.433 | 6.590 | 40.4 | 5.4917 | 7.0 | 329.0 | 16.1 | 395.75 | 9.50 |

| 401 | 14.23620 | 0.0 | 18.10 | 0.0 | 0.693 | 6.343 | 100.0 | 1.5741 | 24.0 | 666.0 | 20.2 | 396.90 | 20.32 |

| 177 | 0.05425 | 0.0 | 4.05 | 0.0 | 0.510 | 6.315 | 73.4 | 3.3175 | 5.0 | 296.0 | 16.6 | 395.60 | 6.29 |

| 69 | 0.12816 | 12.5 | 6.07 | 0.0 | 0.409 | 5.885 | 33.0 | 6.4980 | 4.0 | 345.0 | 18.9 | 396.90 | 8.79 |

1 | y_train.head() |

112 18.8

301 22.0

401 7.2

177 24.6

69 20.9

Name: MEDV, dtype: float64

2. 평가 지표 만들기

2-1. 평가 지표 계산식

(1) MAE (Mean Absolute Error)

MAE (평균 절대 오차): 에측값과 실제값의 차이의 절대값에 대하여 평균을 낸 것

(2) MSE (Mean Squared Error)

MSE (평균 제곱 오차): 예측값과 실제값의 차이의 제곱에 대하여 평균을 낸 것

(3) RMSE (Root Mean Squared Error)

RMSE (평균 제곱근 오차): 예측값과 실제값의 차이의 제곱에 대하여 평균을 낸 뒤 루트를 씌운 것

2-2. 코딩으로 평가 지표 만들어 보기

1 | import numpy as np |

1 | actual = np.array([1, 2, 3]) |

1 | # MAE |

2.0

1 | # MSE |

4.0

1 | # RMSE |

2.0

2-3. sklearn의 평가 지표 활용하기

1 | from sklearn.metrics import mean_absolute_error, mean_squared_error |

[sklearn.metrics.mean_absolute_error]

[sklearn.metrics.mean_squared_error]

1 | # MAE (my_mae VS sklearn_mae) |

(2.0, 2.0)

1 | # MSE (my_mse VS sklearn_mse) |

(4.0, 4.0)

2-4. 모델 성능 확인을 위한 함수

1 | import matplotlib.pyplot as plt |

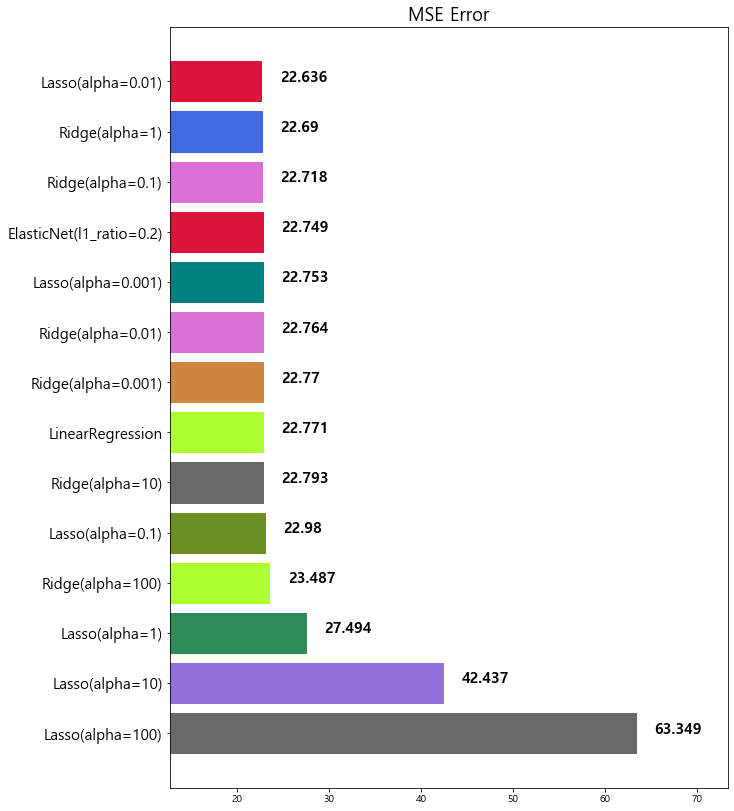

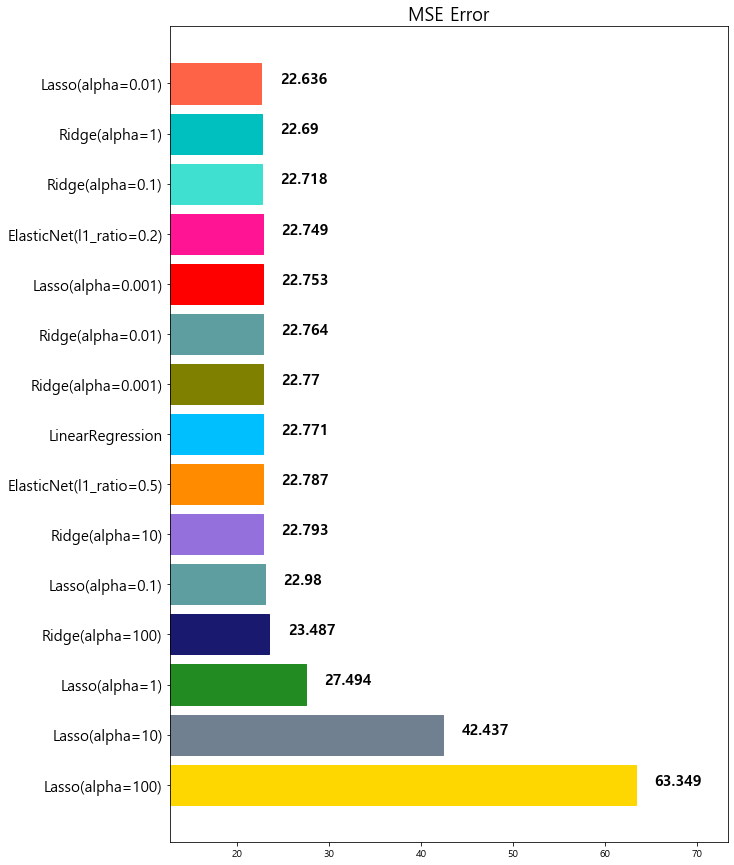

3. 회귀 알고리즘

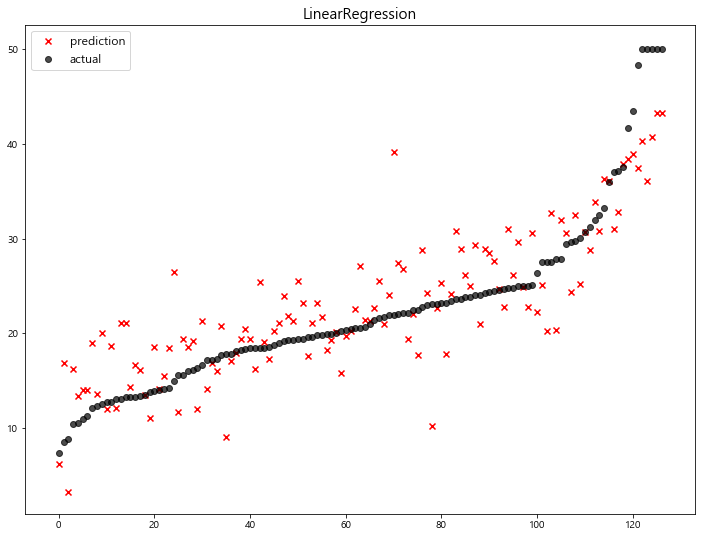

3-1. Linear Regression

[sklearn.linear_model.LinearRegression] Document

1 | from sklearn.linear_model import LinearRegression |

1 | model = LinearRegression(n_jobs=-1) # n_jobs: CPU코어의 사용 |

1 | mse_eval('LinearRegression', y_test, pred) |

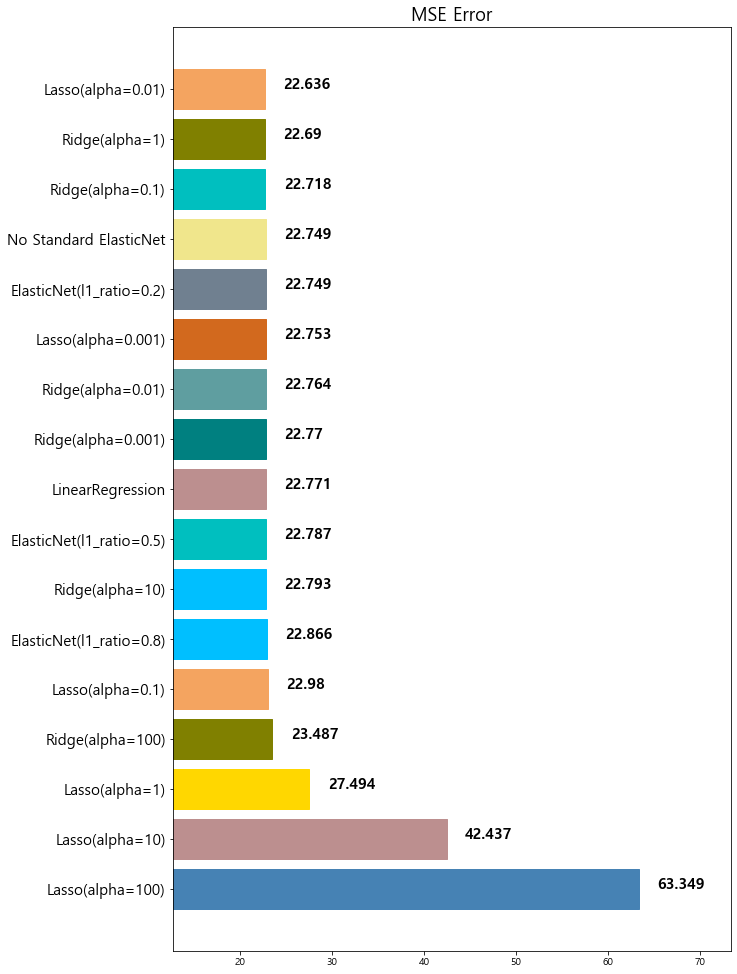

model mse

0 LinearRegression 22.770784

3-2. Ridge & LASSO & ElasticNet

(1) 개념

규제(Regularization): 학습이 과적합 되는 것을 방지하고자 일종의 penalty를 부여하는 것.

[원리] penalty를 부여하여 가중치()를 축소함으로써 학습 모델의 예측 variance를 감소 시키는 것

>> L2 규제 & Ridge (릿지)

-

L2 규제 (L2 Regularization): 각 가중치 제곱의 합에 규제 강도 (Regularization Strength) 를 곱한다

-

Ridge: Loss Function에 L2 규제를 더한 값을 최소화 시키는 것

-

를 크게 하면 가중치() 가 더 많이 감소되고(규제를 중요시 함), 를 작게 하면 가중치() 가 증가한다(규제를 중요시하지 않음)

>> L1 규제 & LASSO (라쏘)

-

L1 규제 (L1 Regularization): 각 가중치 절대값의 합에 규제 강도 (Regularization Strength) 를 곱한다

-

LASSO: Loss Function에 L1 규제를 더한 값을 최소화 시키는 것

-

어떤 가중치() 는 실제로 0이 된다. 즉, 모델에서 완전히 제외되는 특성이 생기는 것이다

>> ElasticNet

l1_ratio (default=0.5)

-

l1_ratio = 0 (L2 규제만 사용)

-

l1_ratio = 1 (L1 규제만 사용)

-

0 < l1_ratio <1 (L1 and L2 규제 혼합사용)

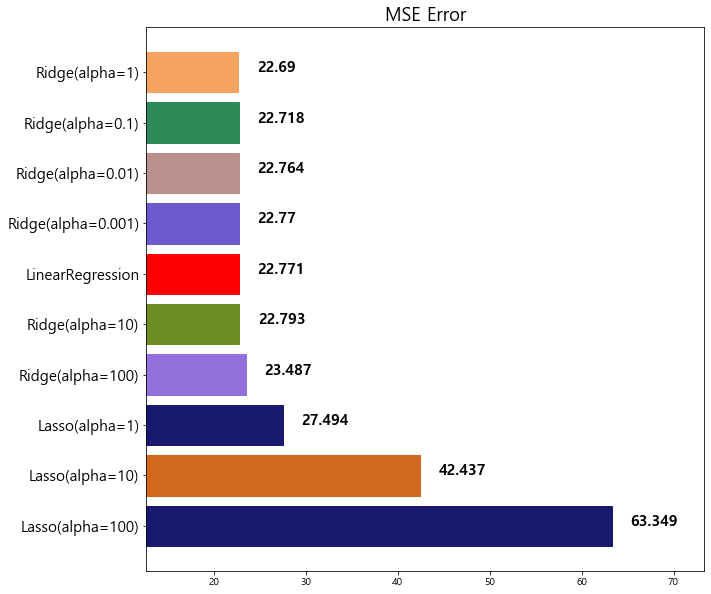

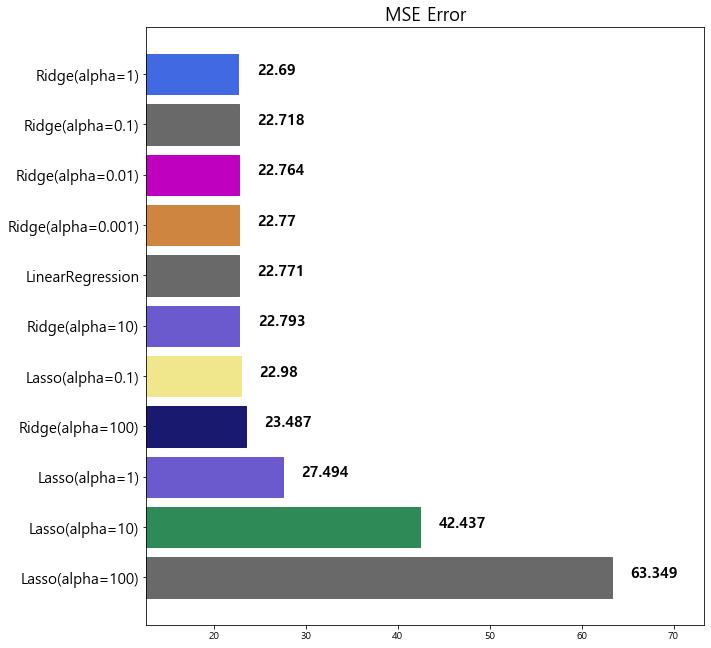

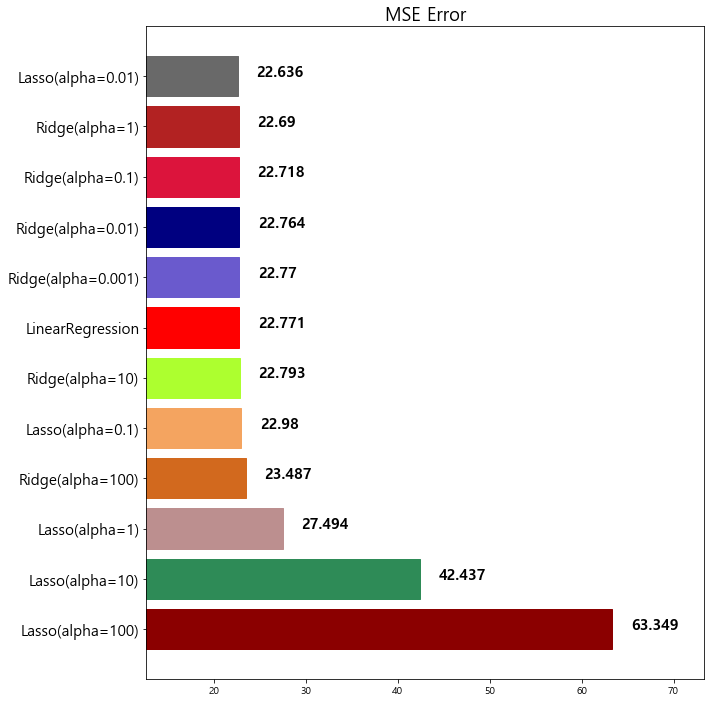

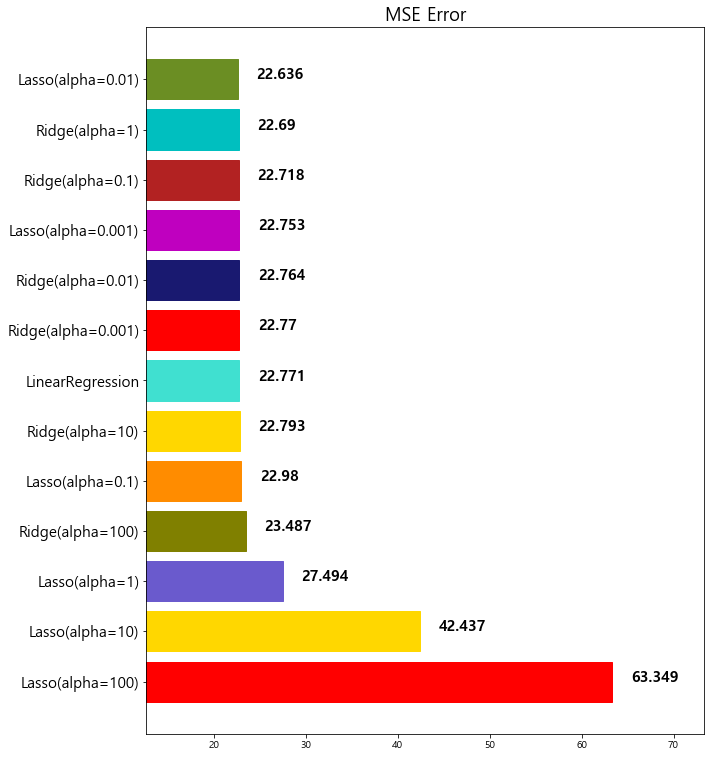

(2) 실습

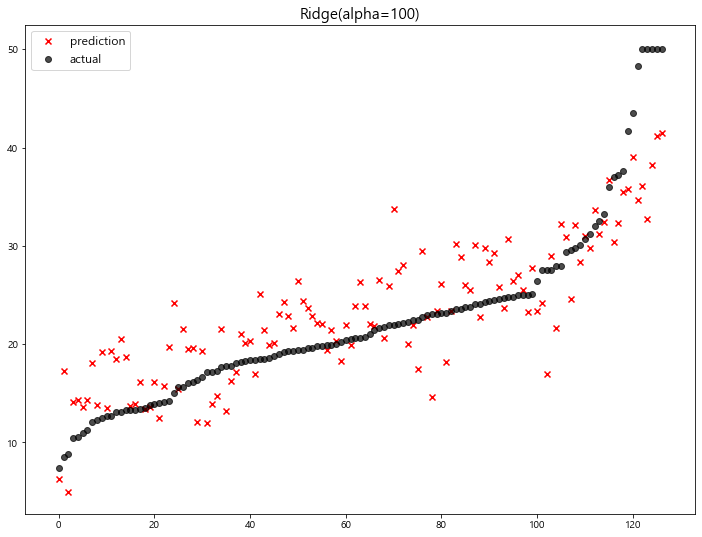

>> Ridge [Document]

1 | from sklearn.linear_model import Ridge |

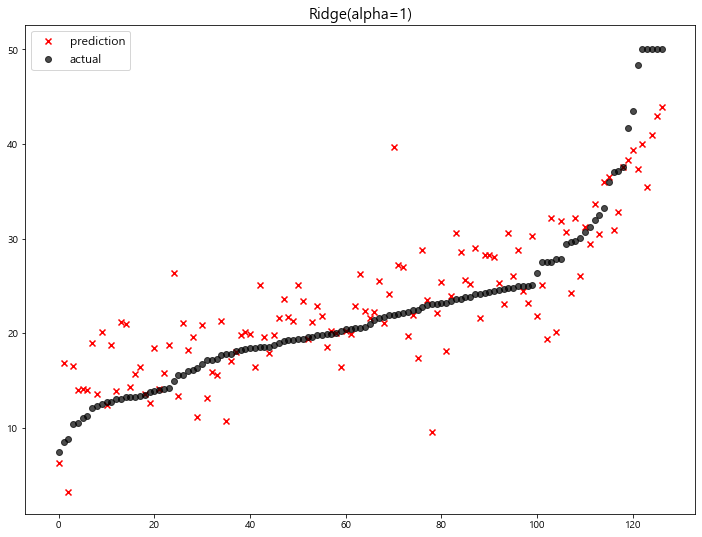

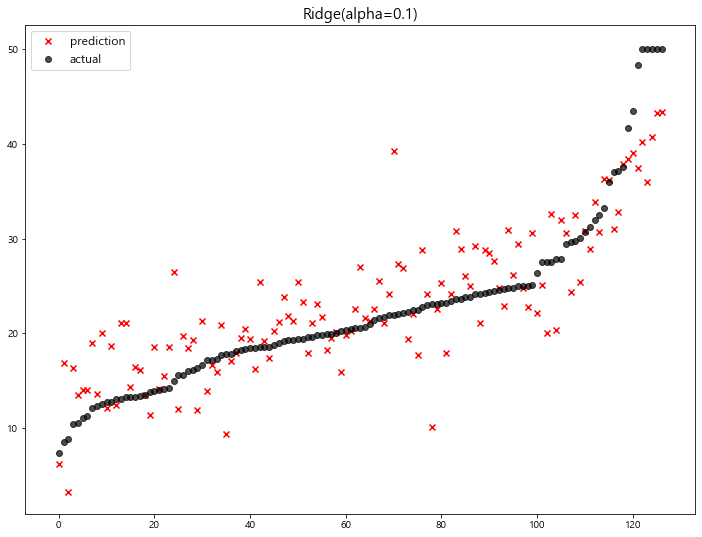

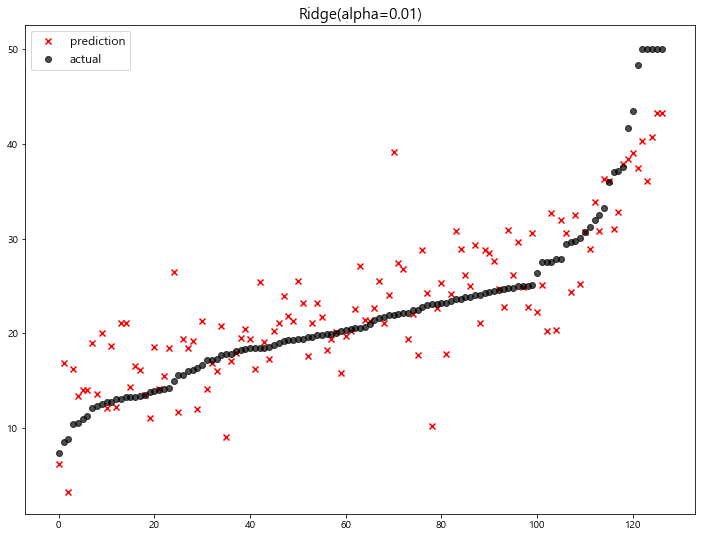

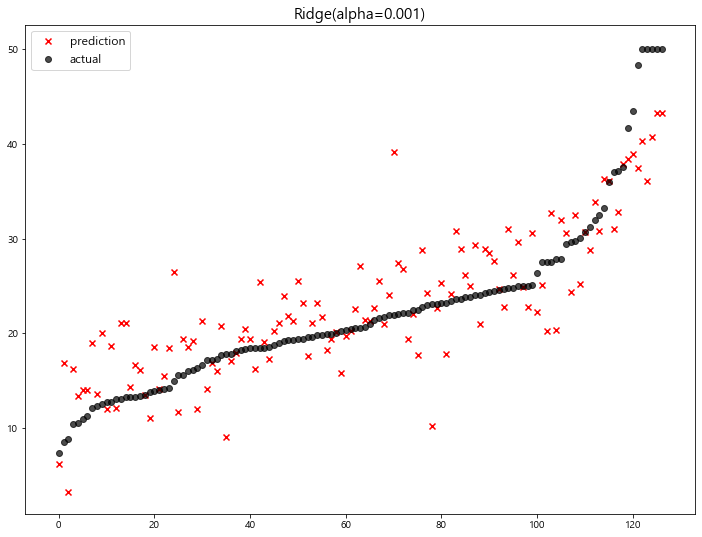

- 예측 결과 확인

1 | # lambda (규제강도) 범위 설정 |

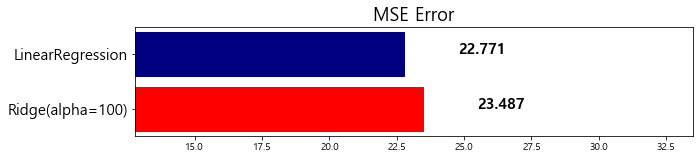

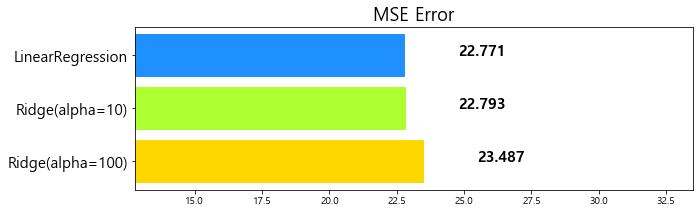

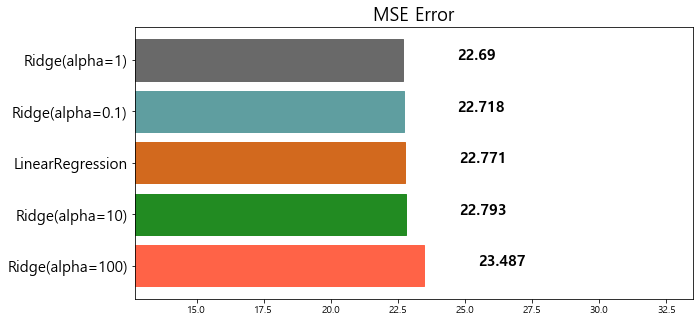

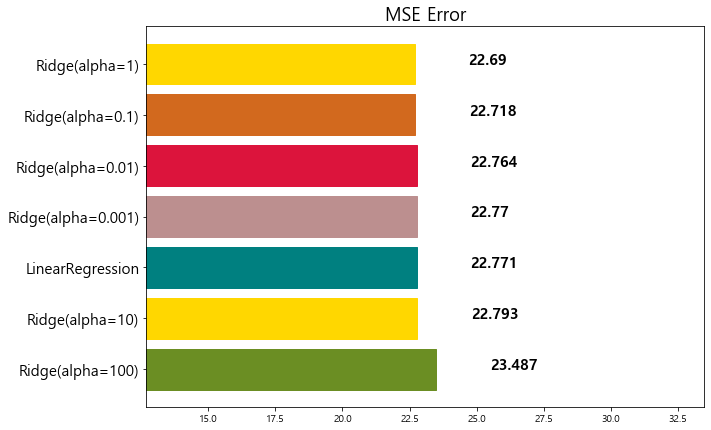

model mse

0 Ridge(alpha=100) 23.487453

1 LinearRegression 22.770784

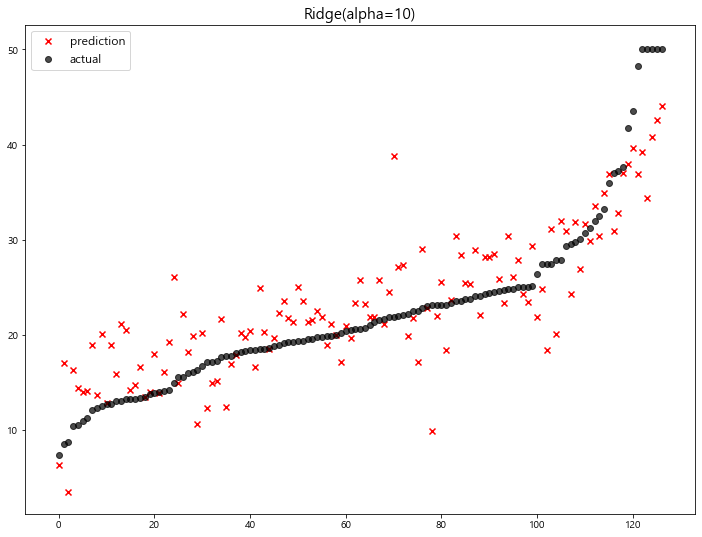

model mse

0 Ridge(alpha=100) 23.487453

1 Ridge(alpha=10) 22.793119

2 LinearRegression 22.770784

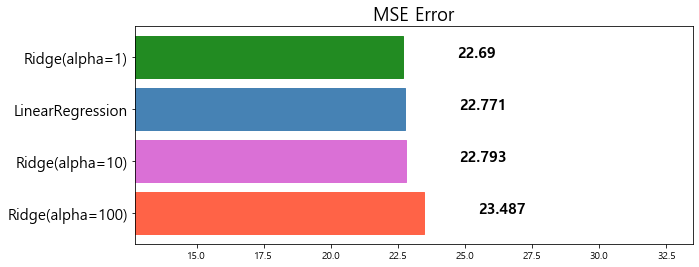

model mse

0 Ridge(alpha=100) 23.487453

1 Ridge(alpha=10) 22.793119

2 LinearRegression 22.770784

3 Ridge(alpha=1) 22.690411

model mse

0 Ridge(alpha=100) 23.487453

1 Ridge(alpha=10) 22.793119

2 LinearRegression 22.770784

3 Ridge(alpha=0.1) 22.718126

4 Ridge(alpha=1) 22.690411

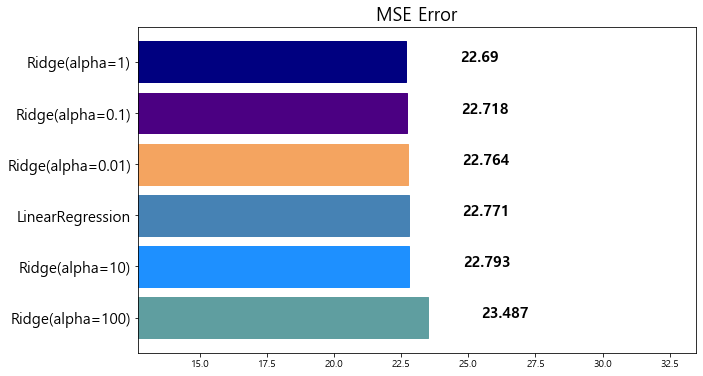

model mse

0 Ridge(alpha=100) 23.487453

1 Ridge(alpha=10) 22.793119

2 LinearRegression 22.770784

3 Ridge(alpha=0.01) 22.764254

4 Ridge(alpha=0.1) 22.718126

5 Ridge(alpha=1) 22.690411

model mse

0 Ridge(alpha=100) 23.487453

1 Ridge(alpha=10) 22.793119

2 LinearRegression 22.770784

3 Ridge(alpha=0.001) 22.770117

4 Ridge(alpha=0.01) 22.764254

5 Ridge(alpha=0.1) 22.718126

6 Ridge(alpha=1) 22.690411

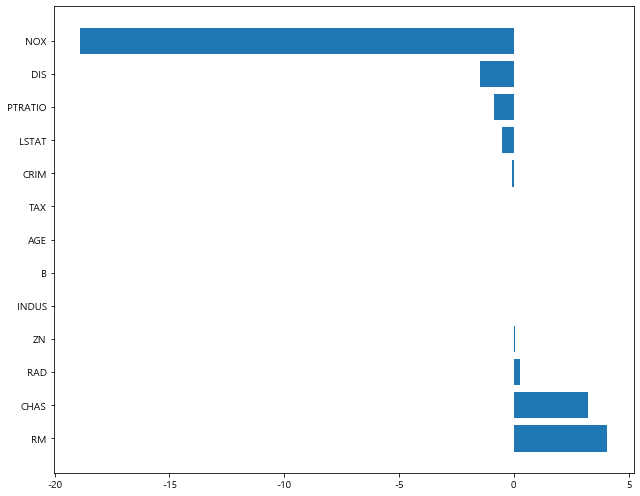

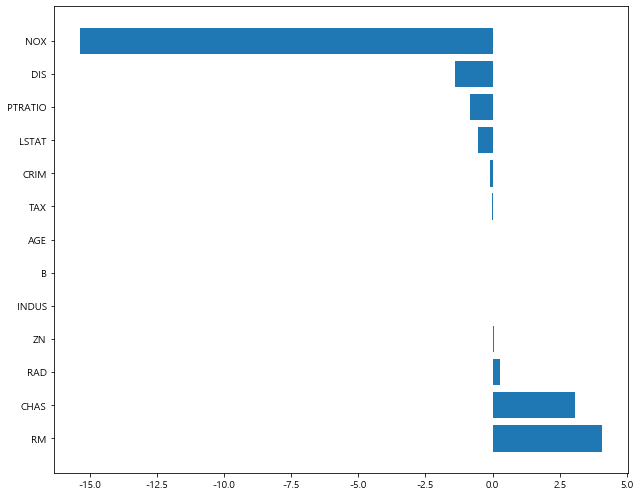

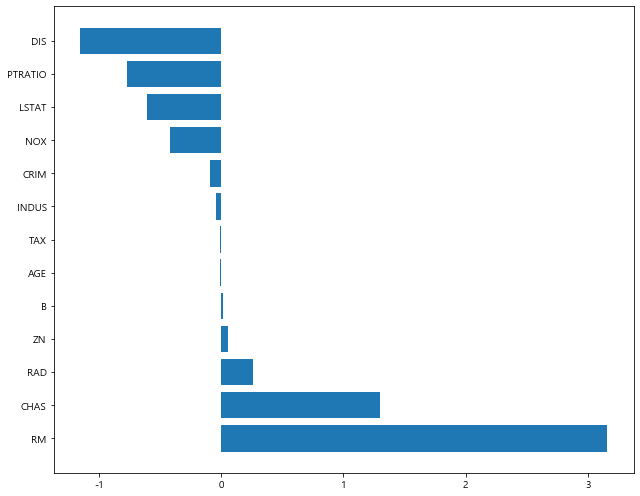

- coefficents 값 확인

1 | x_train.columns |

Index(['CRIM', 'ZN', 'INDUS', 'CHAS', 'NOX', 'RM', 'AGE', 'DIS', 'RAD', 'TAX',

'PTRATIO', 'B', 'LSTAT'],

dtype='object')

1 | ridge.coef_ # for the last alpha in 'alphas' |

array([ -0.09608448, 0.04753482, 0.0259022 , 3.24479273,

-18.89579975, 4.06725732, 0.0020486 , -1.46883742,

0.28149275, -0.0094656 , -0.87454099, 0.01240815,

-0.52406249])

1 | # coefficients visulization |

1 | plot_coef(x_train.columns, ridge.coef_) # alpha = 0.001 |

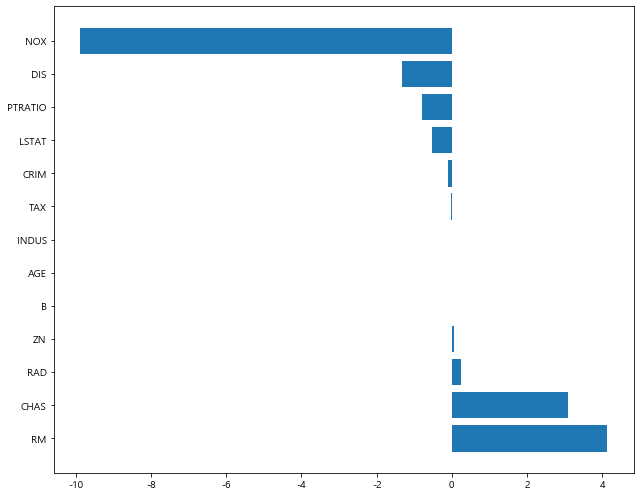

- alpha 값에 따른 coef의 차이

1 | ridge_1 = Ridge(alpha=1) |

1 | plot_coef(x_train.columns, ridge_1.coef_) # alpha = 1 |

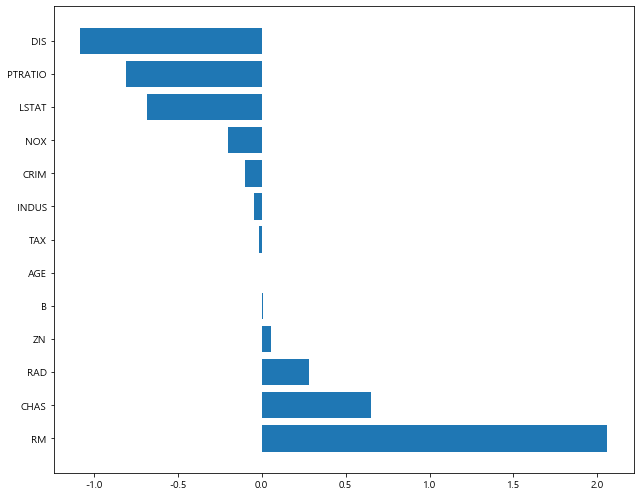

1 | plot_coef(x_train.columns, ridge_100.coef_) # alpha = 100 |

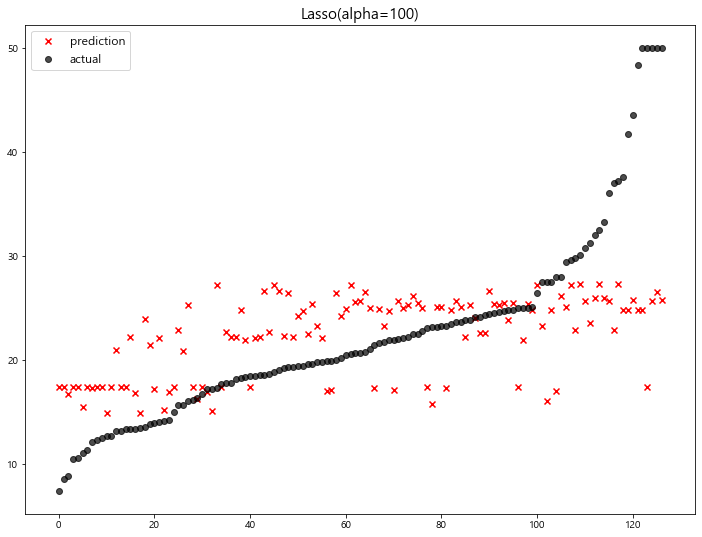

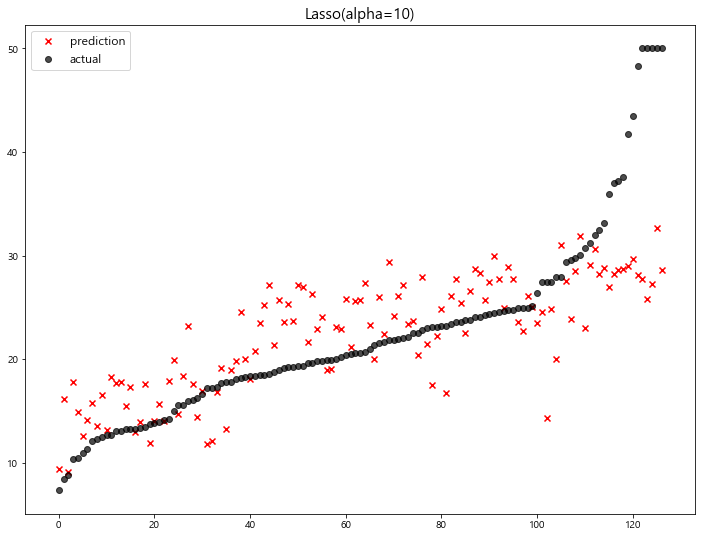

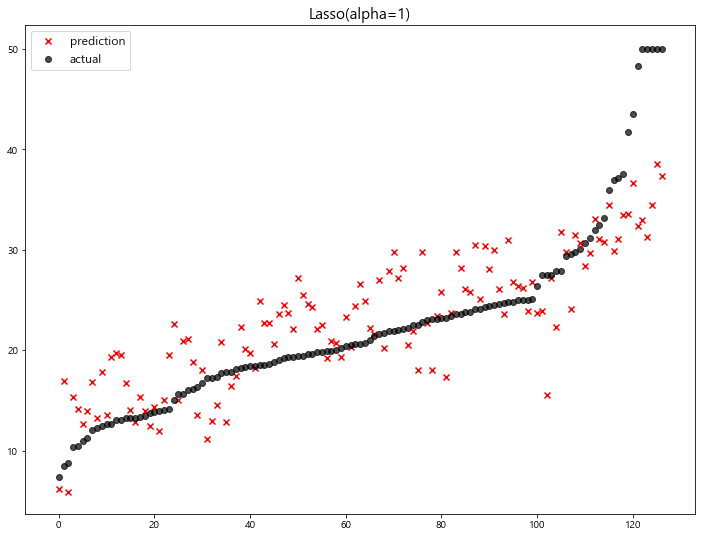

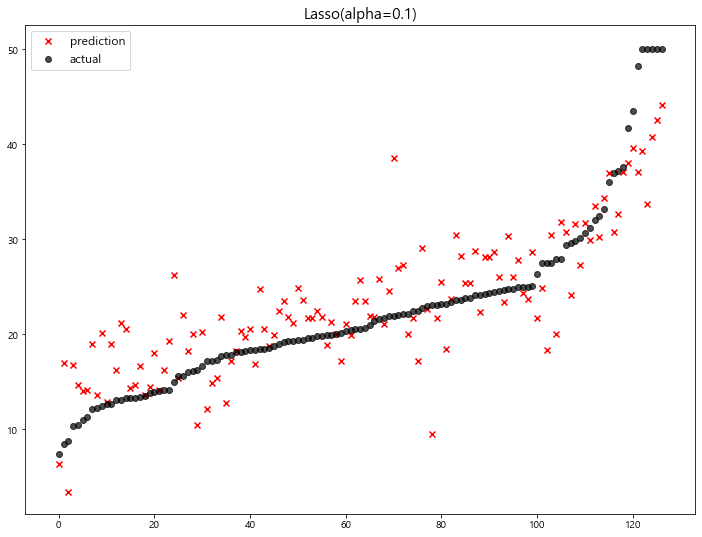

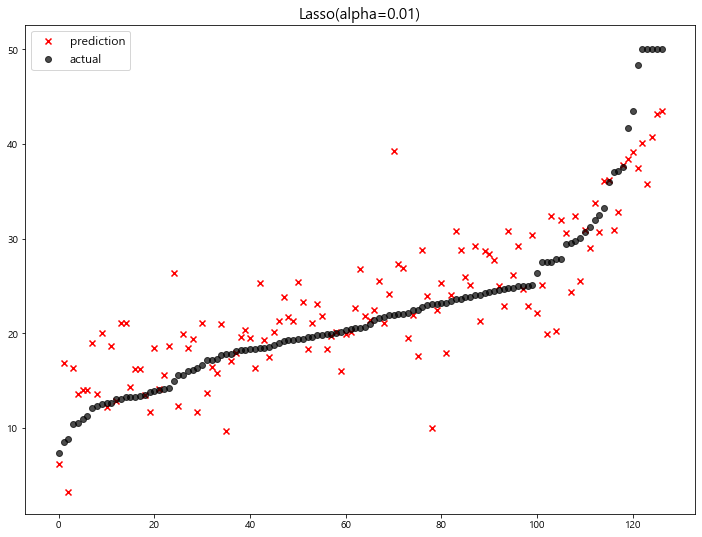

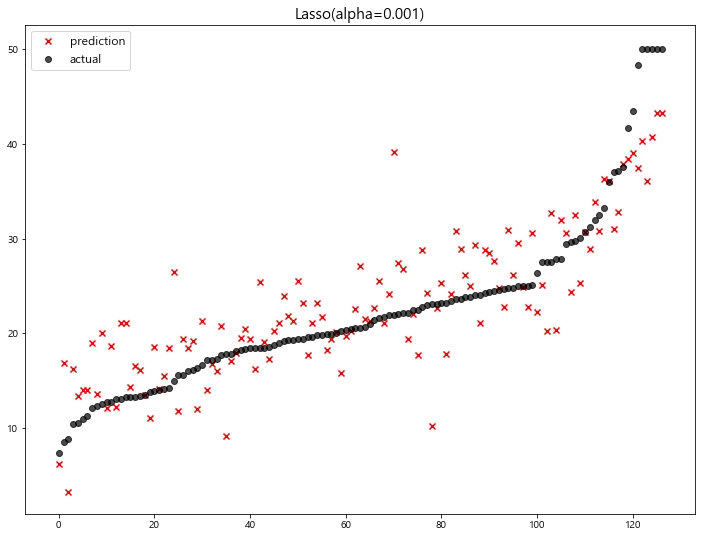

>> LASSO [Document]

1 | from sklearn.linear_model import Lasso |

- 예측 결과 확인

1 | # lambda (규제강도) 범위 설정 |

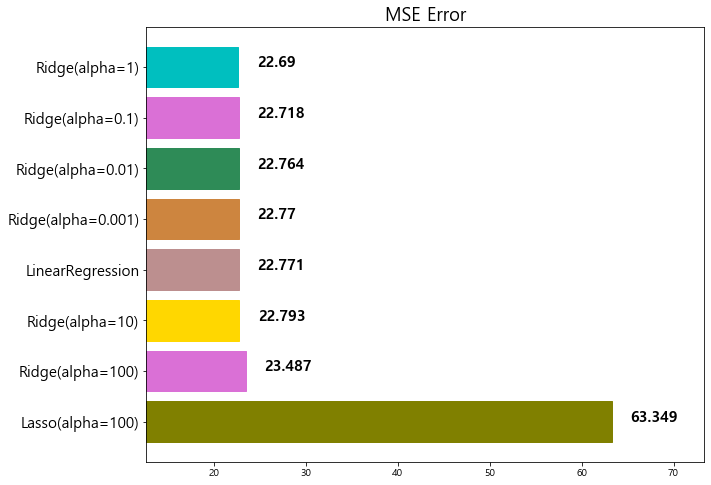

model mse

0 Lasso(alpha=100) 63.348818

1 Ridge(alpha=100) 23.487453

2 Ridge(alpha=10) 22.793119

3 LinearRegression 22.770784

4 Ridge(alpha=0.001) 22.770117

5 Ridge(alpha=0.01) 22.764254

6 Ridge(alpha=0.1) 22.718126

7 Ridge(alpha=1) 22.690411

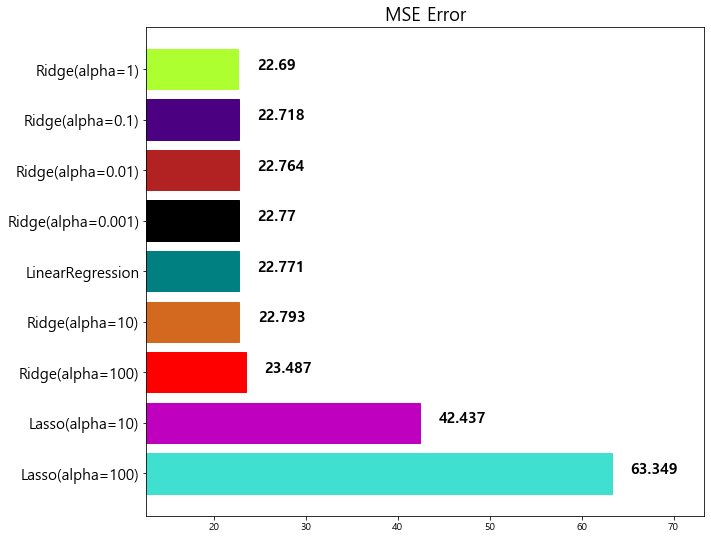

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Ridge(alpha=100) 23.487453

3 Ridge(alpha=10) 22.793119

4 LinearRegression 22.770784

5 Ridge(alpha=0.001) 22.770117

6 Ridge(alpha=0.01) 22.764254

7 Ridge(alpha=0.1) 22.718126

8 Ridge(alpha=1) 22.690411

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Ridge(alpha=10) 22.793119

5 LinearRegression 22.770784

6 Ridge(alpha=0.001) 22.770117

7 Ridge(alpha=0.01) 22.764254

8 Ridge(alpha=0.1) 22.718126

9 Ridge(alpha=1) 22.690411

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Lasso(alpha=0.1) 22.979708

5 Ridge(alpha=10) 22.793119

6 LinearRegression 22.770784

7 Ridge(alpha=0.001) 22.770117

8 Ridge(alpha=0.01) 22.764254

9 Ridge(alpha=0.1) 22.718126

10 Ridge(alpha=1) 22.690411

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Lasso(alpha=0.1) 22.979708

5 Ridge(alpha=10) 22.793119

6 LinearRegression 22.770784

7 Ridge(alpha=0.001) 22.770117

8 Ridge(alpha=0.01) 22.764254

9 Ridge(alpha=0.1) 22.718126

10 Ridge(alpha=1) 22.690411

11 Lasso(alpha=0.01) 22.635614

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Lasso(alpha=0.1) 22.979708

5 Ridge(alpha=10) 22.793119

6 LinearRegression 22.770784

7 Ridge(alpha=0.001) 22.770117

8 Ridge(alpha=0.01) 22.764254

9 Lasso(alpha=0.001) 22.753017

10 Ridge(alpha=0.1) 22.718126

11 Ridge(alpha=1) 22.690411

12 Lasso(alpha=0.01) 22.635614

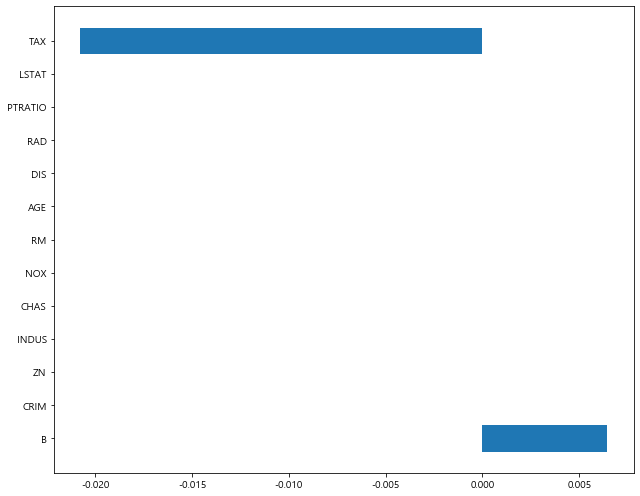

- coefficients 값 확인

1 | # alpha = 0.01 |

[alpha = 0.01]

1 | x_train.columns |

Index(['CRIM', 'ZN', 'INDUS', 'CHAS', 'NOX', 'RM', 'AGE', 'DIS', 'RAD', 'TAX',

'PTRATIO', 'B', 'LSTAT'],

dtype='object')

1 | lasso_01.coef_ |

array([ -0.09427142, 0.04759954, 0.01255668, 3.08256139,

-15.36800113, 4.07373679, -0.00100439, -1.40819927,

0.27152905, -0.0097157 , -0.84377679, 0.01249204,

-0.52790174])

1 | plot_coef(x_train.columns, lasso_01.coef_) |

[alpha = 100]

1 | x_train.columns |

Index(['CRIM', 'ZN', 'INDUS', 'CHAS', 'NOX', 'RM', 'AGE', 'DIS', 'RAD', 'TAX',

'PTRATIO', 'B', 'LSTAT'],

dtype='object')

1 | lasso_100.coef_ |

array([-0. , 0. , -0. , 0. , -0. ,

0. , -0. , 0. , -0. , -0.02078349,

-0. , 0.00644409, -0. ])

1 | plot_coef(x_train.columns, lasso_100.coef_) |

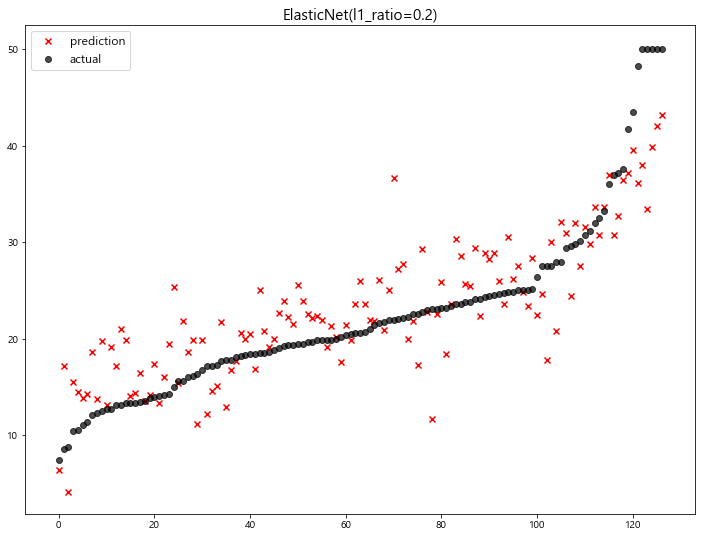

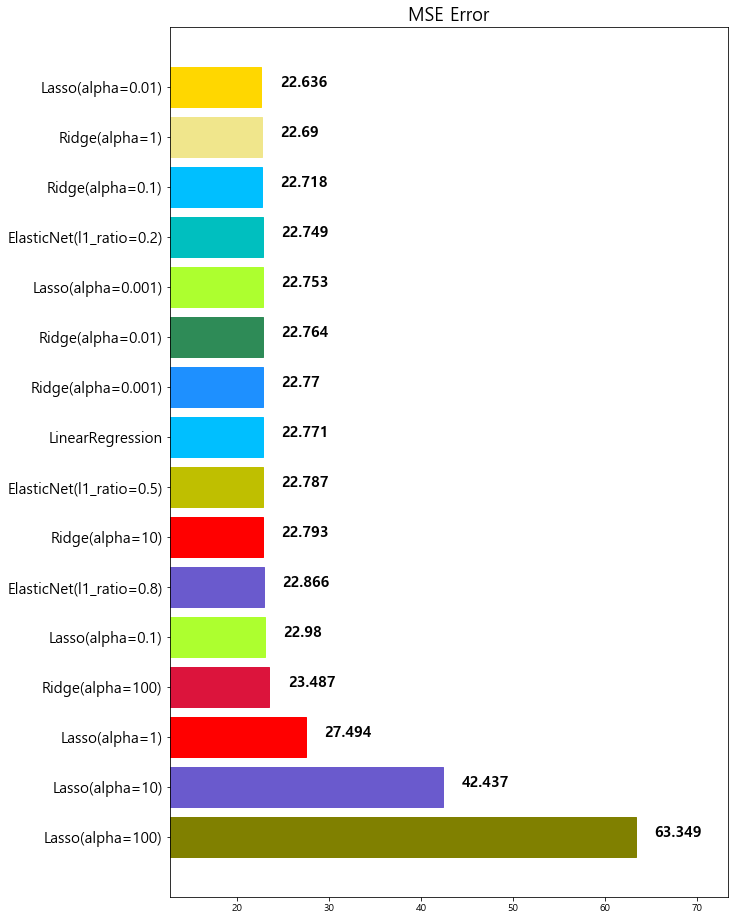

>> ElasticNet [Document]

1 | from sklearn.linear_model import ElasticNet |

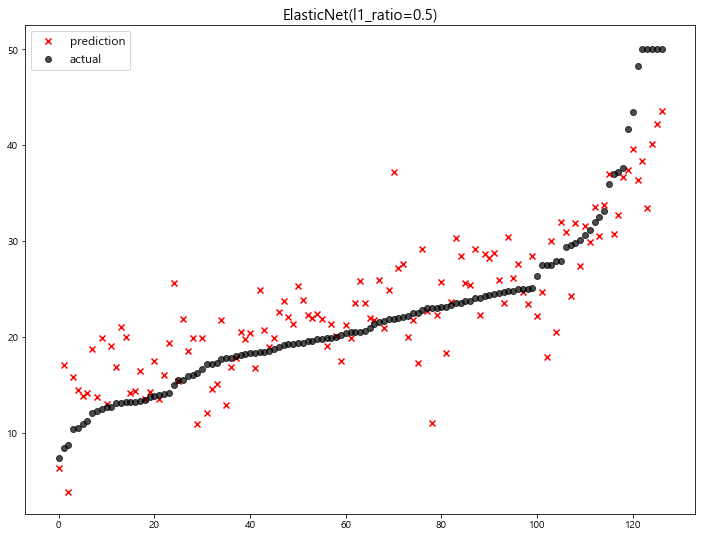

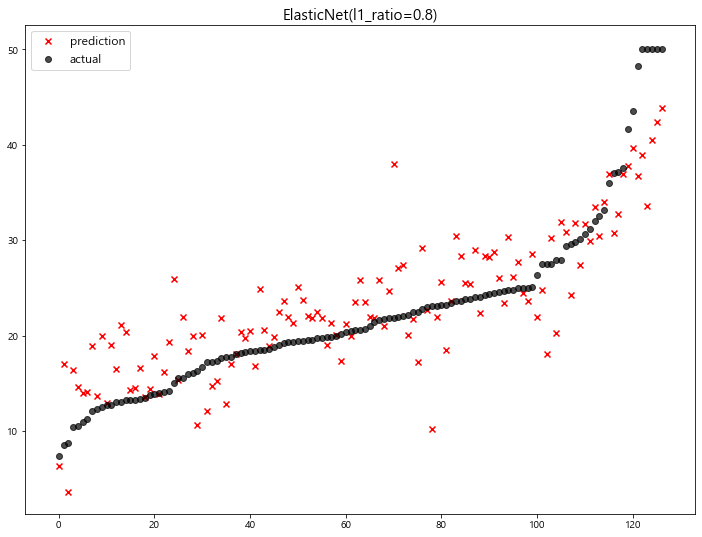

- 예측 결과 확인

1 | ratios = [0.2, 0.5, 0.8] |

1 | # alpha = 0.5 로 고정 |

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Lasso(alpha=0.1) 22.979708

5 Ridge(alpha=10) 22.793119

6 LinearRegression 22.770784

7 Ridge(alpha=0.001) 22.770117

8 Ridge(alpha=0.01) 22.764254

9 Lasso(alpha=0.001) 22.753017

10 ElasticNet(l1_ratio=0.2) 22.749018

11 Ridge(alpha=0.1) 22.718126

12 Ridge(alpha=1) 22.690411

13 Lasso(alpha=0.01) 22.635614

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Lasso(alpha=0.1) 22.979708

5 Ridge(alpha=10) 22.793119

6 ElasticNet(l1_ratio=0.5) 22.787269

7 LinearRegression 22.770784

8 Ridge(alpha=0.001) 22.770117

9 Ridge(alpha=0.01) 22.764254

10 Lasso(alpha=0.001) 22.753017

11 ElasticNet(l1_ratio=0.2) 22.749018

12 Ridge(alpha=0.1) 22.718126

13 Ridge(alpha=1) 22.690411

14 Lasso(alpha=0.01) 22.635614

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Lasso(alpha=0.1) 22.979708

5 ElasticNet(l1_ratio=0.8) 22.865628

6 Ridge(alpha=10) 22.793119

7 ElasticNet(l1_ratio=0.5) 22.787269

8 LinearRegression 22.770784

9 Ridge(alpha=0.001) 22.770117

10 Ridge(alpha=0.01) 22.764254

11 Lasso(alpha=0.001) 22.753017

12 ElasticNet(l1_ratio=0.2) 22.749018

13 Ridge(alpha=0.1) 22.718126

14 Ridge(alpha=1) 22.690411

15 Lasso(alpha=0.01) 22.635614

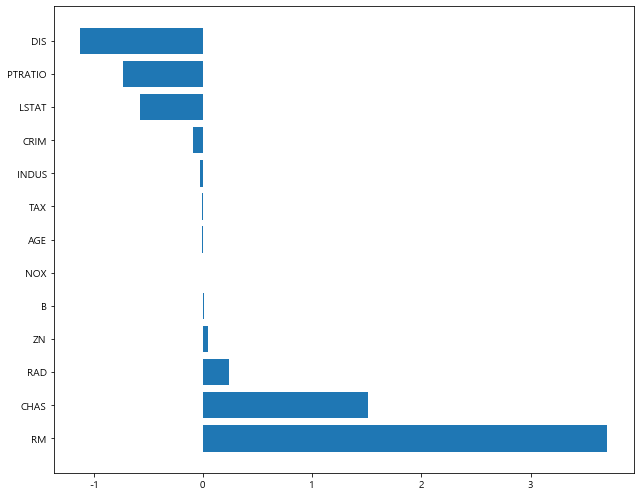

- coefficients 값 확인

1 | # ㅣ1_ratio = 0.2 |

[ l1_ratio = 0.2 ]

1 | x_train.columns |

Index(['CRIM', 'ZN', 'INDUS', 'CHAS', 'NOX', 'RM', 'AGE', 'DIS', 'RAD', 'TAX',

'PTRATIO', 'B', 'LSTAT'],

dtype='object')

1 | elasticnet_2.coef_ |

array([-0.09297585, 0.05293361, -0.03950412, 1.30126199, -0.41996826,

3.15838796, -0.00644646, -1.15290012, 0.25973467, -0.01231233,

-0.77186571, 0.01201684, -0.60780037])

1 | plot_coef(x_train.columns, elasticnet_2.coef_) |

[ l1_ratio = 0.8 ]

1 | x_train.columns |

Index(['CRIM', 'ZN', 'INDUS', 'CHAS', 'NOX', 'RM', 'AGE', 'DIS', 'RAD', 'TAX',

'PTRATIO', 'B', 'LSTAT'],

dtype='object')

1 | elasticnet_8.coef_ |

array([-0.08797633, 0.05035601, -0.03058513, 1.51071961, -0. ,

3.70247373, -0.01017259, -1.12431077, 0.24389841, -0.01189981,

-0.73481448, 0.01259147, -0.573733 ])

1 | plot_coef(x_train.columns, elasticnet_8.coef_) |

4. Scaling

4-1. Scaler 소개

-

StandardScaler

-

MinMaxScaler

-

RobustScaler

1 | from sklearn.preprocessing import StandardScaler, MinMaxScaler, RobustScaler |

1 | x_train.describe() |

| CRIM | ZN | INDUS | CHAS | NOX | RM | AGE | DIS | RAD | TAX | PTRATIO | B | LSTAT | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 | 379.000000 |

| mean | 3.512192 | 11.779683 | 10.995013 | 0.076517 | 0.548712 | 6.266953 | 67.223483 | 3.917811 | 9.282322 | 404.680739 | 18.448549 | 357.048100 | 12.633773 |

| std | 8.338717 | 23.492842 | 6.792065 | 0.266175 | 0.115006 | 0.681796 | 28.563787 | 2.084167 | 8.583051 | 166.813256 | 2.154917 | 92.745266 | 7.259213 |

| min | 0.006320 | 0.000000 | 0.460000 | 0.000000 | 0.385000 | 3.561000 | 2.900000 | 1.129600 | 1.000000 | 188.000000 | 12.600000 | 2.520000 | 1.730000 |

| 25% | 0.078910 | 0.000000 | 5.190000 | 0.000000 | 0.445000 | 5.876500 | 42.250000 | 2.150900 | 4.000000 | 278.000000 | 17.150000 | 375.425000 | 6.910000 |

| 50% | 0.228760 | 0.000000 | 9.690000 | 0.000000 | 0.532000 | 6.208000 | 74.400000 | 3.414500 | 5.000000 | 330.000000 | 19.000000 | 392.110000 | 11.380000 |

| 75% | 2.756855 | 19.000000 | 18.100000 | 0.000000 | 0.624000 | 6.611000 | 93.850000 | 5.400900 | 8.000000 | 666.000000 | 20.200000 | 396.260000 | 16.580000 |

| max | 73.534100 | 100.000000 | 27.740000 | 1.000000 | 0.871000 | 8.398000 | 100.000000 | 10.585700 | 24.000000 | 711.000000 | 22.000000 | 396.900000 | 37.970000 |

>> StandardScaler

평균(mean)을 0, 표준편차(std)를 1로 만들어 주는 scaler

1 | std_scaler = StandardScaler() |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 |

| mean | -0.00 | 0.00 | 0.00 | -0.00 | -0.00 | -0.00 | -0.00 | 0.00 | -0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| std | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| min | -0.42 | -0.50 | -1.55 | -0.29 | -1.43 | -3.97 | -2.25 | -1.34 | -0.97 | -1.30 | -2.72 | -3.83 | -1.50 |

| 25% | -0.41 | -0.50 | -0.86 | -0.29 | -0.90 | -0.57 | -0.88 | -0.85 | -0.62 | -0.76 | -0.60 | 0.20 | -0.79 |

| 50% | -0.39 | -0.50 | -0.19 | -0.29 | -0.15 | -0.09 | 0.25 | -0.24 | -0.50 | -0.45 | 0.26 | 0.38 | -0.17 |

| 75% | -0.09 | 0.31 | 1.05 | -0.29 | 0.66 | 0.51 | 0.93 | 0.71 | -0.15 | 1.57 | 0.81 | 0.42 | 0.54 |

| max | 8.41 | 3.76 | 2.47 | 3.47 | 2.81 | 3.13 | 1.15 | 3.20 | 1.72 | 1.84 | 1.65 | 0.43 | 3.49 |

>> MinMaxScaler

min값과 max값을 0~1사이로 정규화 (Normalize)

1 | minmax_scaler = MinMaxScaler() |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 | 379.00 |

| mean | 0.05 | 0.12 | 0.39 | 0.08 | 0.34 | 0.56 | 0.66 | 0.29 | 0.36 | 0.41 | 0.62 | 0.90 | 0.30 |

| std | 0.11 | 0.23 | 0.25 | 0.27 | 0.24 | 0.14 | 0.29 | 0.22 | 0.37 | 0.32 | 0.23 | 0.24 | 0.20 |

| min | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 25% | 0.00 | 0.00 | 0.17 | 0.00 | 0.12 | 0.48 | 0.41 | 0.11 | 0.13 | 0.17 | 0.48 | 0.95 | 0.14 |

| 50% | 0.00 | 0.00 | 0.34 | 0.00 | 0.30 | 0.55 | 0.74 | 0.24 | 0.17 | 0.27 | 0.68 | 0.99 | 0.27 |

| 75% | 0.04 | 0.19 | 0.65 | 0.00 | 0.49 | 0.63 | 0.94 | 0.45 | 0.30 | 0.91 | 0.81 | 1.00 | 0.41 |

| max | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

>> RobustScaler

중앙값(median)이 0, IQR(interquartile rage)이 1이 되도록 변환

outlier 처리에 유용

1 | robust_scaler = RobustScaler() |

0 0.0

1 0.0

2 0.0

3 0.0

4 0.0

5 0.0

6 0.0

7 0.0

8 0.0

9 0.0

10 0.0

11 0.0

12 0.0

dtype: float64

4-2. Scaling 후 모델 학습 – 파이프라인 활용

1 | from sklearn.pipeline import make_pipeline |

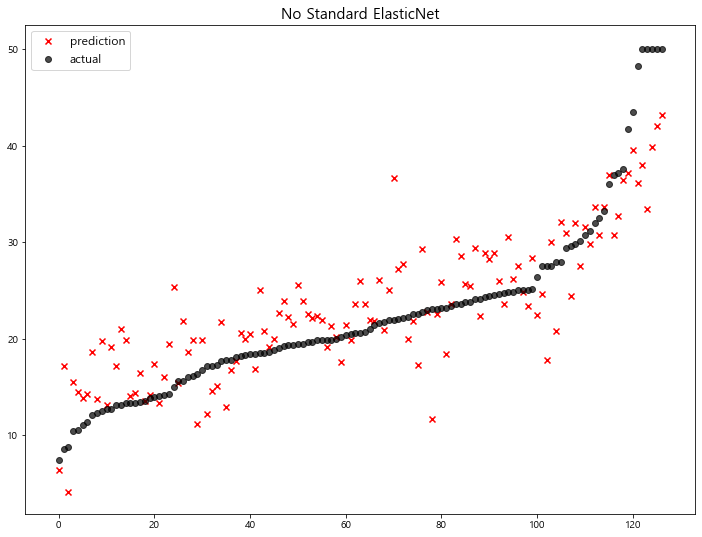

1 | # elasticnet(alpha=0.1, l1_ratio=0.2) < without standard scaling > |

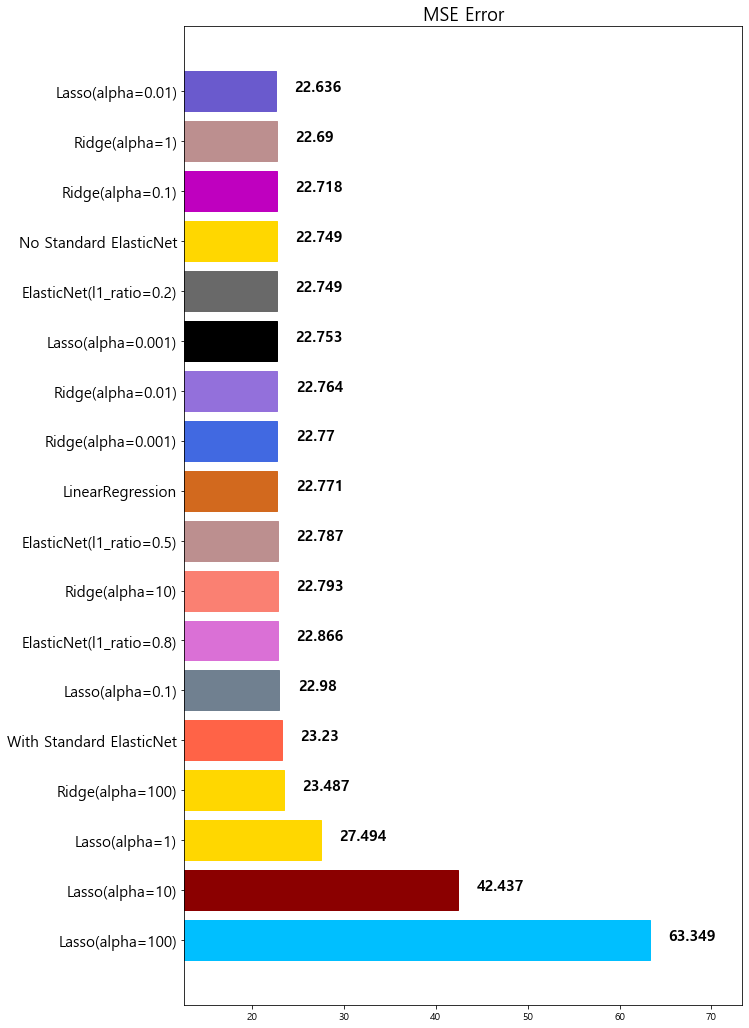

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 Lasso(alpha=0.1) 22.979708

5 ElasticNet(l1_ratio=0.8) 22.865628

6 Ridge(alpha=10) 22.793119

7 ElasticNet(l1_ratio=0.5) 22.787269

8 LinearRegression 22.770784

9 Ridge(alpha=0.001) 22.770117

10 Ridge(alpha=0.01) 22.764254

11 Lasso(alpha=0.001) 22.753017

12 ElasticNet(l1_ratio=0.2) 22.749018

13 No Standard ElasticNet 22.749018

14 Ridge(alpha=0.1) 22.718126

15 Ridge(alpha=1) 22.690411

16 Lasso(alpha=0.01) 22.635614

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

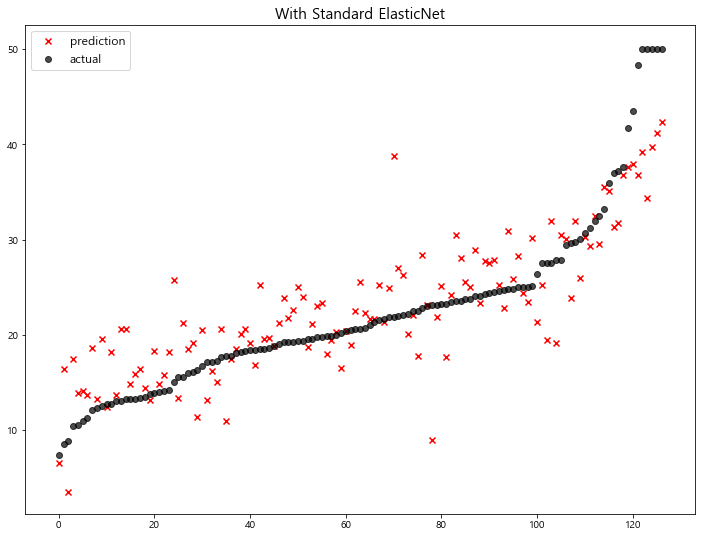

4 With Standard ElasticNet 23.230164

5 Lasso(alpha=0.1) 22.979708

6 ElasticNet(l1_ratio=0.8) 22.865628

7 Ridge(alpha=10) 22.793119

8 ElasticNet(l1_ratio=0.5) 22.787269

9 LinearRegression 22.770784

10 Ridge(alpha=0.001) 22.770117

11 Ridge(alpha=0.01) 22.764254

12 Lasso(alpha=0.001) 22.753017

13 ElasticNet(l1_ratio=0.2) 22.749018

14 No Standard ElasticNet 22.749018

15 Ridge(alpha=0.1) 22.718126

16 Ridge(alpha=1) 22.690411

17 Lasso(alpha=0.01) 22.635614

5. Polynomial Features

다항식의 계수간 상호작용을 통해 새로운 feature를 생성한다.

예를 들면, [a, b] 2개의 feature가 존재한다고 가정하고,

degree=2로 설정한다면, polynomial features 는 [1, a, b, a^2, ab, b^2]가 돤다

1 | from sklearn.preprocessing import PolynomialFeatures |

Polynomial Features 생성

1 | poly = PolynomialFeatures(degree=2, include_bias=False) |

1 | poly_features = poly.fit_transform(x_train)[0] |

array([ 0.12329 , 0. , 10.01 , 0. ,

0.547 , 5.913 , 92.9 , 2.3534 ,

6. , 432. , 17.8 , 394.95 ,

16.21 , 0.01520042, 0. , 1.2341329 ,

0. , 0.06743963, 0.72901377, 11.453641 ,

0.29015069, 0.73974 , 53.26128 , 2.194562 ,

48.6933855 , 1.9985309 , 0. , 0. ,

0. , 0. , 0. , 0. ,

0. , 0. , 0. , 0. ,

0. , 0. , 100.2001 , 0. ,

5.47547 , 59.18913 , 929.929 , 23.557534 ,

60.06 , 4324.32 , 178.178 , 3953.4495 ,

162.2621 , 0. , 0. , 0. ,

0. , 0. , 0. , 0. ,

0. , 0. , 0. , 0.299209 ,

3.234411 , 50.8163 , 1.2873098 , 3.282 ,

236.304 , 9.7366 , 216.03765 , 8.86687 ,

34.963569 , 549.3177 , 13.9156542 , 35.478 ,

2554.416 , 105.2514 , 2335.33935 , 95.84973 ,

8630.41 , 218.63086 , 557.4 , 40132.8 ,

1653.62 , 36690.855 , 1505.909 , 5.53849156,

14.1204 , 1016.6688 , 41.89052 , 929.47533 ,

38.148614 , 36. , 2592. , 106.8 ,

2369.7 , 97.26 , 186624. , 7689.6 ,

170618.4 , 7002.72 , 316.84 , 7030.11 ,

288.538 , 155985.5025 , 6402.1395 , 262.7641 ])

1 | x_train.iloc[0] |

CRIM 0.12329

ZN 0.00000

INDUS 10.01000

CHAS 0.00000

NOX 0.54700

RM 5.91300

AGE 92.90000

DIS 2.35340

RAD 6.00000

TAX 432.00000

PTRATIO 17.80000

B 394.95000

LSTAT 16.21000

Name: 112, dtype: float64

Polynomial Features + Standard Scaling 후 모델 학습

1 | poly_pipeline = make_pipeline( |

1 | poly_pred = poly_pipeline.fit(x_train, y_train).predict(x_test) |

D:\Anaconda\lib\site-packages\sklearn\linear_model\_coordinate_descent.py:476: ConvergenceWarning: Objective did not converge. You might want to increase the number of iterations. Duality gap: 32.61172784964583, tolerance: 3.2374824854881266

positive)

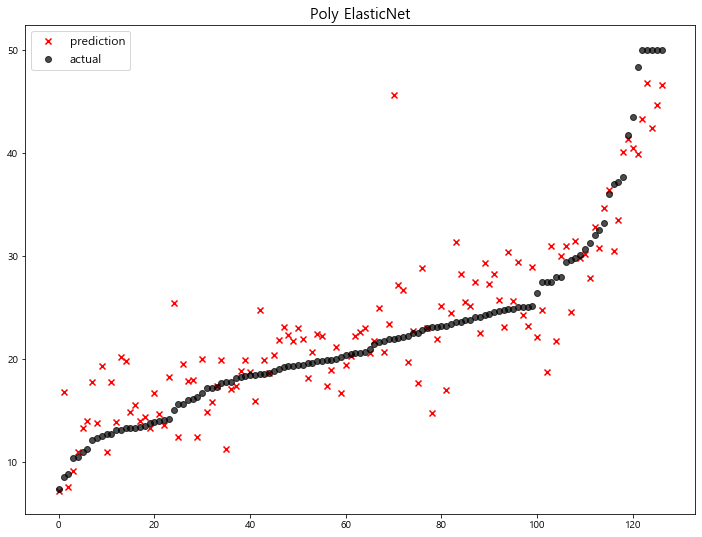

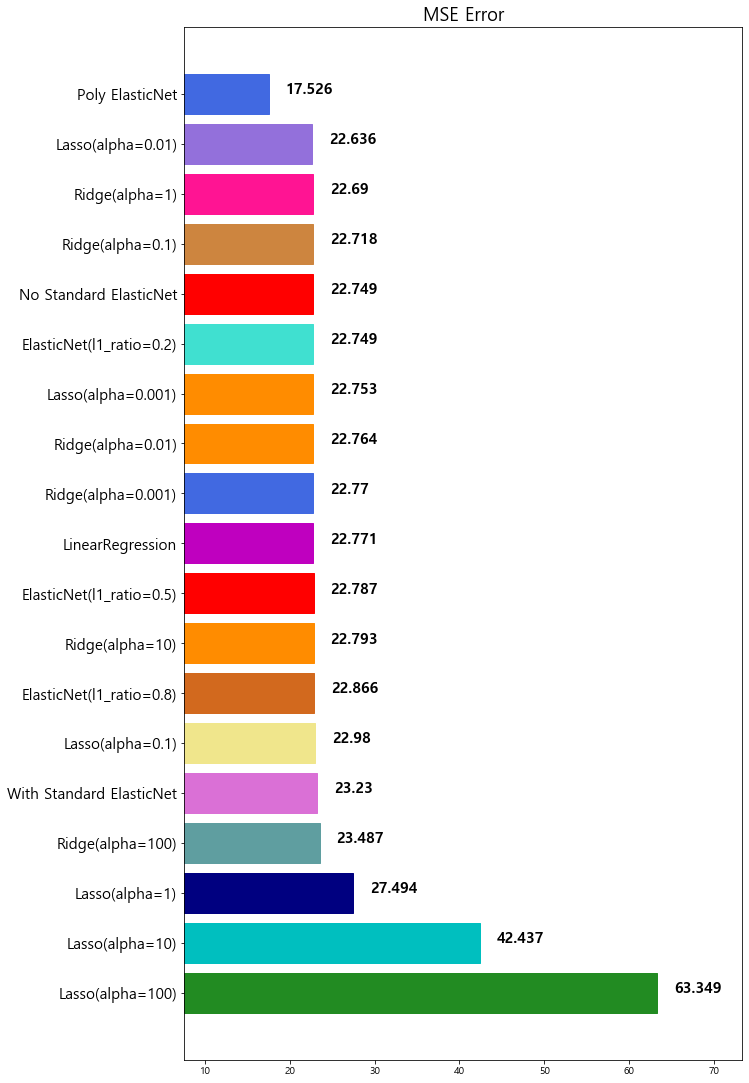

1 | mse_eval('Poly ElasticNet', y_test, poly_pred) |

model mse

0 Lasso(alpha=100) 63.348818

1 Lasso(alpha=10) 42.436622

2 Lasso(alpha=1) 27.493672

3 Ridge(alpha=100) 23.487453

4 With Standard ElasticNet 23.230164

5 Lasso(alpha=0.1) 22.979708

6 ElasticNet(l1_ratio=0.8) 22.865628

7 Ridge(alpha=10) 22.793119

8 ElasticNet(l1_ratio=0.5) 22.787269

9 LinearRegression 22.770784

10 Ridge(alpha=0.001) 22.770117

11 Ridge(alpha=0.01) 22.764254

12 Lasso(alpha=0.001) 22.753017

13 ElasticNet(l1_ratio=0.2) 22.749018

14 No Standard ElasticNet 22.749018

15 Ridge(alpha=0.1) 22.718126

16 Ridge(alpha=1) 22.690411

17 Lasso(alpha=0.01) 22.635614

18 Poly ElasticNet 17.526214

2차 Polynomial Features 추가 후 학습된 모델의 성능이 많이 향상 된것을 확인할 수 있다